Do you want to know the hard truth? IFTA fuel tax reporting isn’t exactly the most exciting part of the trucking industry. Tracking miles across state lines, sorting through fuel receipts, and manually crunching numbers? That’s a logbook nightmare waiting to happen. Did you know that 71.4% of the total freight is moved by trucks countrywide? And, of course, the fear of penalties, audits, and wasted hours is always there. At this point, the IFTA trucking software comes to the rescue.

Think about a system that automates the fuel tax calculations, integrates with your ELD, and generates the reports without any hassle. You do not have to scramble for data—it is fast, reliable, and fully automated IFTA reporting.

So whether you are an owner-operator or a fleet manager, the right IFTA reporting software can keep you compliant without missing a beat. Let’s take a closer look at IFTA software details.

What is IFTA, and why do trucking companies need IFTA Software

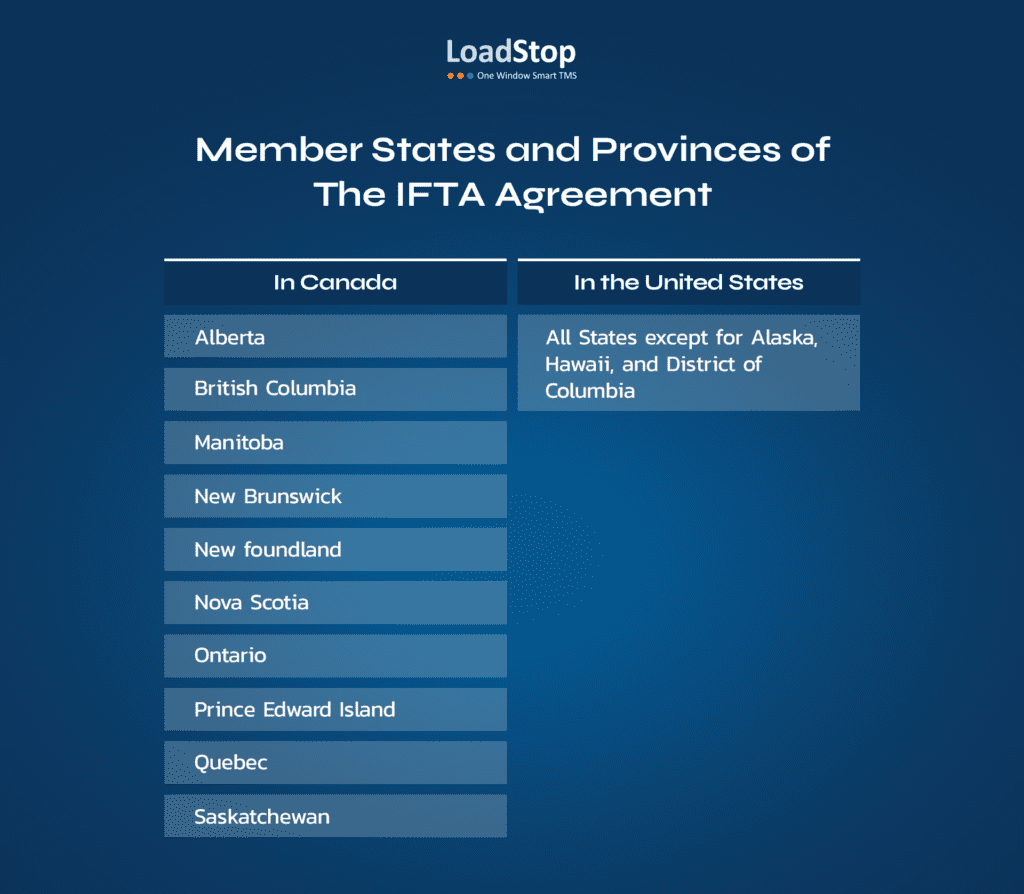

The International Fuel Tax Agreement (IFTA) is an agreement between the 48 contiguous US states and 10 Canadian provinces that aims to simplify fuel usage reporting for motor carriers operating in multiple jurisdictions.

Previously, each state had its own unique set of fuel tax reporting rules and regulations. Under IFTA, carriers now only need to report fuel usage to their base jurisdictions, which collect taxes on net fuel usage and disburse funds to other states.

Overall, the International Fuel Tax Agreement (IFTA) streamlines the process of transferring fuel taxes across different states.

It’s important to remember that IFTA doesn’t impose an additional tax. Rather, its purpose is to redistribute the tax to the states where the fuel is consumed, as opposed to where it’s bought.

This implies that regardless of where you purchase the fuel, you’ll be charged the fuel tax in the states where you drive.

Who needs IFTA

If a carrier is headquartered in a member state and conducts business in two or more member jurisdictions, it must have an IFTA license. The kind of car they drive is another factor to take into account.

According to IFTA, a qualified motor vehicle is designed and utilized for the transportation of people or property. Additionally, eligible automobiles must meet any of the following requirements:

- Any car that weighs more than 11,797 kilograms (26,000 pounds) and has two axles

- Any vehicle having three or more axles, regardless of weight

- A car weighing more than 11,797 kg (26,000 lbs)

Information needed for IFTA reporting

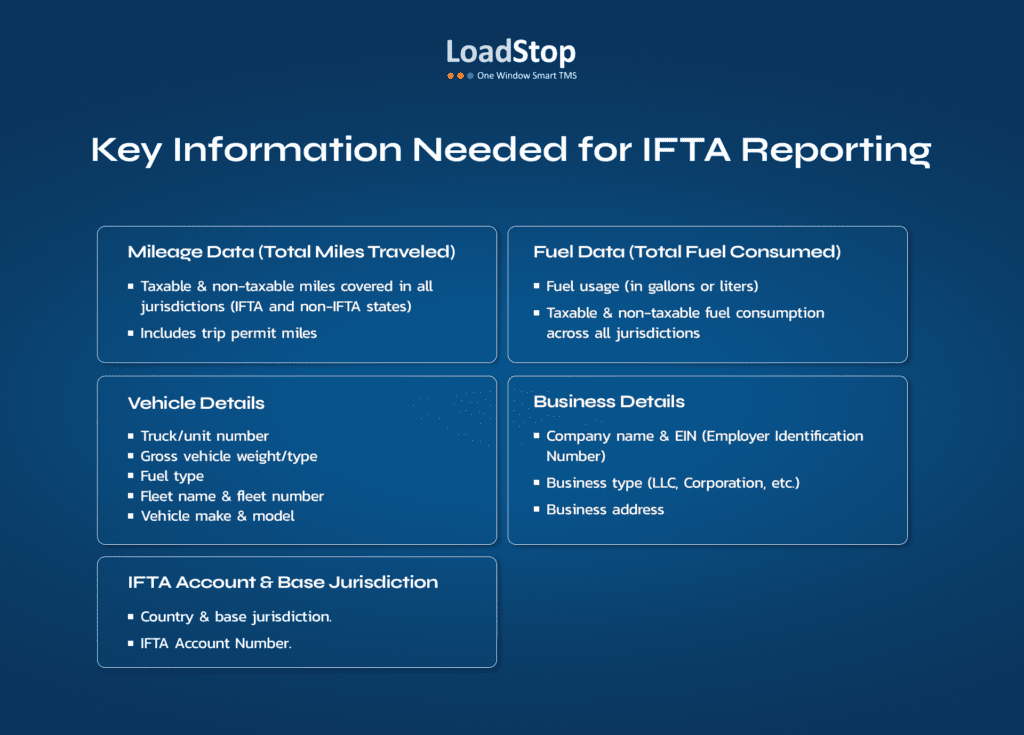

The basic information required to generate IFTA reports every quarter includes the following:

- The total number of miles, both taxable and nontaxable, traveled by the IFTA licensee’s qualified motor vehicle(s) in all jurisdictions/states, irrespective of their participation in IFTA. This encompasses all trip permit miles.

- The total amount of fuel, in gallons or liters, consumed by a qualifying motor vehicle, both taxable and nontaxable, in all jurisdictions/states, regardless of their participation in IFTA.

- Specific details about the vehicle include its truck/unit number, gross vehicle type, fuel type, fleet name, fleet number, make, and model.

- Business details include EIN, company name, business type, and address.

- IFTA details include the country, base jurisdiction, and IFTA Account Number.

How to file an IFTA report

You can file IFTA reports in three different ways: electronically, by mail, and walk-in.

- Electronically: If you submit your return electronically, it will be regarded as received on the submission date.

- By Mail: If you send it by mail, the postmark date on the envelope will determine the receipt date.

- Walk-in: However, if you choose to deliver it in person, your return will be deemed received on the day it is delivered to the office.

How to apply for IFTA license and decals

Filling out the application form used in your home state is the first step if you require an IFTA license.

Different application forms may be used for different purposes. The IFTA application form, for instance, can be used by Ohio-based carriers to modify their accounts or seek more decals.

The following are some of the fundamental carrier details needed for new IFTA applications:

- Name of registered business

- Address for mail

- USDOT number

- Federal business number

Completed IFTA forms can be mailed after being downloaded online. In other jurisdictions, IFTA forms can also be submitted via taxpayer service offices or by fax. Official IFTA decals for the current year will be issued by the IFTA authority in your state when your application has been accepted. Until your decals arrive, you can fax a temporary IFTA license.

How IFTA software lowers operational costs

Manual IFTA reporting can be prone to errors, which can become a snowball right away. Switching to the automated IFTA software can help trucking companies to:

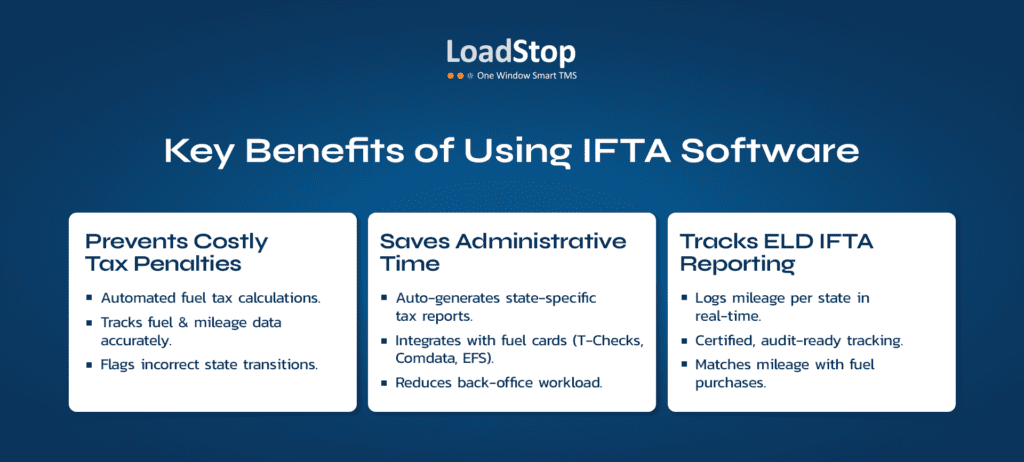

Prevents costly tax penalties

One inaccurate fuel tax return could result in fines, penalties, or even license revocation, thus, IFTA audit miscalculations can be avoided by:

- Automating fuel tax computations with real-time jurisdictional tax rates, IFTA software removes the possibility of errors.

- To guarantee compliance, precise fuel purchases and mileage data are tracked.

- To identify improper state transitions, state adjacency checks are carried out.

You will always submit accurate reports using the advanced IFTA reporting system; there won’t be any penalties or worries—just proper compliance.

Saves administrative time

It takes a lot of time to manually calculate gasoline costs, mileage per state, and tax obligations. All of this is done promptly using IFTA software, which benefits fleets:

- Without requiring human input, automatically generate tax reports in state-specific formats.

- For smooth reporting, combine gasoline card data from T-Checks, Comdata, and EFS.

- Reduce the amount of work in the back office so that employees can concentrate on more important duties.

Trucking firms reduce manual labor hours and reporting hassles with IFTA reporting software because time saved equates to money made.

Tracks ELD IFTA reporting

Fuel and mileage information must be exact for the most accurate tax computations. Every trip’s information is immediately recorded, thanks to ELD-integrated IFTA reporting. The LoadStop system:

- Logs mileage in real time by state by syncing directly with ELD devices.

- In order to ensure compliance and cost accuracy, mileage is matched with gasoline purchases using PC Miler Miles, which offers certified, audit-ready distance tracking.

LoadStop’s ELD-powered IFTA reporting guarantees maximum accuracy, minimal risk, and zero lost cash by doing away with human mistakes and manual data entry.

Choosing the best IFTA reporting software for your fleet

Not every trucking software offers the same valuable features. So, when you are looking for IFTA reporting software, keep the following factors in mind to ensure it matches the fleet’s needs:

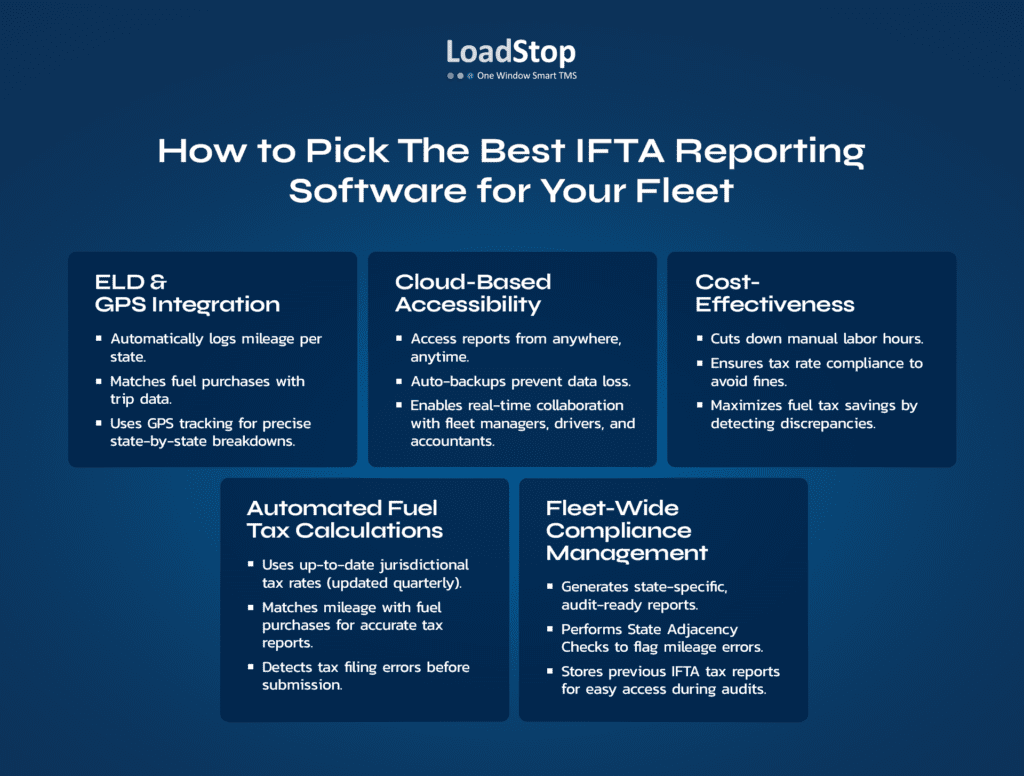

1. ELD and GPS integration

A fleet operating across Texas, Oklahoma, and Kansas cannot rely on drivers to manually log miles per state. Therefore, an ELD-integrated IFTA software can do all the manual chores on their behalf. Tracking is super easy with the GPS tracking system that:

- Automatically records mileage per state.

- Ensures every gallon is accounted for and syncs the fuel purchases with each trip.

- Use real-time GPS tracking to provide precise state-by-state breakdowns.

2. Cloud-based accessibility

What if a driver fuels up in California, but the back-office team is in Chicago? The cloud-based IFTA reporting feature allows instant access to fuel purchase data, track mileage, and reports. The cloud-based solution ensures:

- Real-time access to reports from any location.

- Automatic data backup so no tax records are lost.

- Collaboration with drivers, fleet managers, and accounting teams.

3. Cost-effectiveness

A trucking company could invest dozens of hours per quarter processing IFTA reports by hand. The expense quickly mounts up when you multiply it by employee wages. These hours are reduced to minutes with automated IFTA reporting software, which saves money and time.

The ideal approach should be to:

- Automate reporting and computations to cut down on the costs of human labor.

- Avoid tax fines by making sure that current jurisdictional rates are followed.

- By detecting inconsistencies or overpaying taxes, you may maximize your gasoline tax savings.

4. Automated fuel tax calculations

Your software should automatically determine the precise tax liability if your fleet travels 5,000 miles in many states with different fuel tax rates. Fuel tax computations are intricate and dynamic.

Your IFTA software ought to:

- Automatically compute taxes using the most recent jurisdictional rates, which are updated every three months.

- For accurate reporting, match fuel purchases to mileage.

- To avoid overpaying or mistakes in tax filing, find disparities.

5. Fleet-wide compliance management

You don’t want to be searching through documents or looking for misplaced gasoline receipts in the event of an audit. Your fleet will stay completely compliant, audit-ready, and penalty-free with a centralized, automated IFTA reporting system.

Whether you oversee a small fleet or a large one, compliance needs to be simple and expandable.

- State-specific reports that are prepared for simple tax filing should be generated by your software.

- Before submitting, do State Adjacency Checks to identify any mileage problems.

- Save previous tax returns to ease audit anxiety.

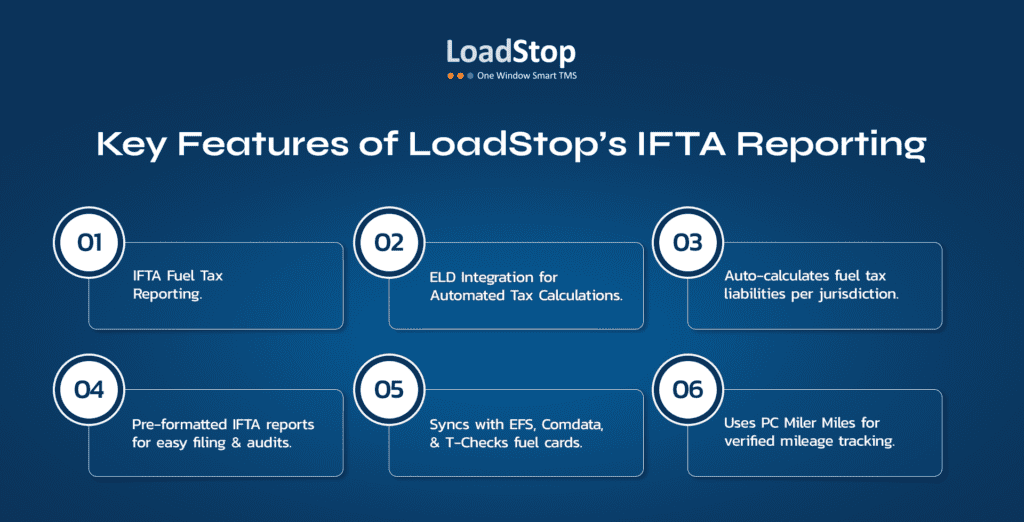

LoadStop’s IFTA reporting feature for trucking companies

It can be a difficult task to deal with multiple jurisdictions, tax rate fluctuations, and compliance requirements. Hence the reason LoadStop TMS offers a fully automated, real-time reporting and integrations with ELD devices for fuel card and mileage tracking system.

1. IFTA fuel tax reporting

The best part of using LoadStop is the ease of real-time tracking of fuel purchases and consumption. You can integrate ELD devices and fuel card systems. The platform will automatically capture fuel transactions and mileage data, eliminating the chances of manual errors. With this feature, you can ensure that every gallon of fuel purchased or driven miles are recorded and reported accurately.

2. ELD integrations for automated tax calculations

Carriers are interested in integrating ELD devices and mileage tracking tools like PC Miler Miles. What they need is the state-by-state mileage breakdown so that they can log trip mileage while reducing the risk of miscalculations. With the help of LoadStop IFTA reporting software, you can sync the calculations in real time so that there’s no need for drivers or back-office staff to enter data manually.

3. IFTA automation

The purpose of automation is to file complex reports more easily. The automated IFTA reporting feature calculates fuel tax liabilities for each jurisdiction, updates the tax rates quarterly, and ensures full compliance with the regulations. This significantly decreases the need of manual paperwork and also saves time.

4. Customized reporting templates

To make things easier for carriers, customized reporting templates that align with regulatory compliance are offered. With the help of templates, not only can you generate accurate reports for easy tax filing and prep for audit, but it also provides more flexibility and ease of use.

5. Integrations with fuel cards

Fuel cards are heaven-sent for the trucking companies. But having direct integrations with major fuel card providers such as EFS, Comdata, and T-Checks is one of the top-notch features offered to carriers. The system automatically pulls fuel purchase data, cross-matches it with the trip mileage, and calculates exact fuel tax liabilities.

This is very helpful in maintaining reporting accuracy and ensuring that trucking companies get the most accurate tax calculations.

6. State adjacency checks for accuracy

LoadStop interfaces with PC Miler Miles to provide certified state-by-state mileage computations, ensuring high-precision mileage tracking.

Additionally, the system flags non-adjacent state transitions to prevent entry errors through State Adjacency Checks. LoadStop ensures data accuracy and flexibility by warning users of problems while preserving the option to overrule and continue if needed.

Make IFTA compliance easier with LoadStop

We get it, it is not easy to manually track mileage, fuel purchases, and tax rates. Also, let’s not forget that it can lead to costly mistakes. The right IFTA trucking software can allow one to automate calculations, maintain compliance, and focus on the fleets. That’s where LoadStop TMS comes in with its real-time fuel tracking and ELD integrations accompanied with automated tax calculations and reporting templates, simplifying the entire process. Why not take care of the last-minute tax headaches in just a few clicks?

Smart trucking runs on automation

Book a DemoFAQs

Yes! IFTA software reduces manual work, minimizes errors that lead to penalties, and helps track fuel efficiency. Automating tax calculations saves valuable time and money, letting trucking companies focus on operations instead of paperwork.

IFTA software is far more accurate than manual reporting. It automatically pulls mileage and fuel data, eliminating human errors and missed entries. This ensures compliance and prevents costly tax audits or penalties.

LoadStop simplifies IFTA reporting by automating fuel tax calculations, tracking mileage, and generating accurate reports with just a few clicks. It integrates with ELDs and fuel card data, eliminating manual entries and reducing the risk of errors. This saves time, ensures compliance, and helps trucking companies avoid costly penalties.