As a part of the trucking business, you are already aware of the trucking insurance rates and how they can make or break your bottom line. If you are an owner-operator who is interested in keeping low costs to manage their trucks or are searching for the right commercial insurance trucking policy, getting a fair price is a challenge

The right insurance keeps your trucking business protected when accidents or damage occurs. But the big question is how you can lower the insurance cost for trucking. We are here to find the solutions and strategies to make insurance affordable for your business.

Why trucking insurance rate is essential

Trucking is one of the underrated livelihoods. Whether you haul freight across the country or make local deliveries, every trucking business needs insurance to protect it from damages and unbearable costs. Just think about it: a driver en route for a high-value load is cut off by another vehicle, causing an accident. Now, as bad as it may sound, you will feel better knowing you have insurance for truck repairs, cargo damage, and medical bills for the driver.

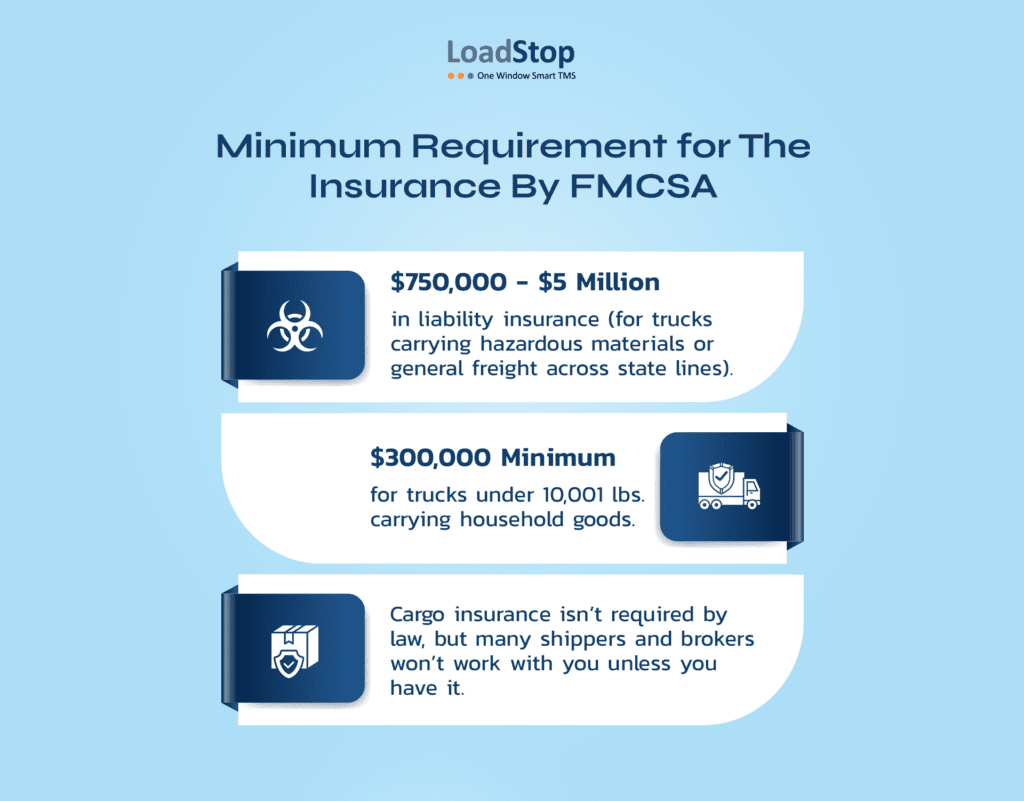

In the US, trucking companies must carry insurance. The Federal Carrier Safety Administrations (FMCSA) has set a minimum requirement for the insurance according to the haul type:

- $750,000 – $5 million in liability insurance (for trucks carrying hazardous materials or general freight across state lines).

- $300,000 minimum for trucks under 10,001 lbs. carrying household goods.

- Cargo insurance isn’t required by law, but many shippers and brokers won’t work with you unless you have it.

How the right insurance policy can help the trucking business

In case you are caught driving without insurance, you could face hefty fines and license suspension and may even lose your business. So think of insurance as the seatbelt for your business. The right coverage will keep you financially safe. Here’s how:

- If you are in a crash, insurance helps pay for damages and medical bills.

- In case your loads get damaged or stolen, cargo insurance is helpful to recover the finances for the items.

- Keeping compliant for the right coverage means you can avoid fines or sudden shutdown.

- Having a liability instance helps cover legal fees and settlements, etc.

Factors that influence trucking insurance rates

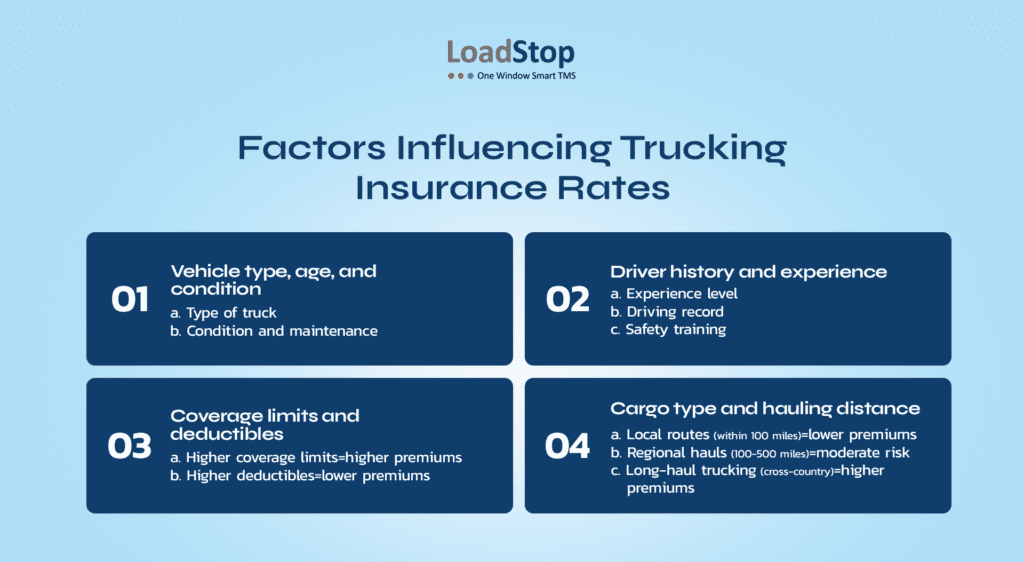

Did you ever wonder why trucking insurance rates vary so much? Insurance companies calculate your premiums based on multiple risk factors. Keeping this scenario in mind, you need to understand the dynamics of these risk factors that have an impact on the rates:

Vehicle type, age, and condition

Truck is one of the biggest factors that affects insurance costs. Insurers keep an eye for detail for the:

- Type of truck: A heavy-duty semi-truck will cost more than a light-duty box truck because of the size, repair costs, and accident risk. If it’s a specialized truck, there will be higher premiums.

- Condition and maintenance: A well-maintained truck with regular inspection schedules is at a lesser risk. That’s why insurers check on the maintenance records, which is why it helps keep a lower rate.

Driver history and experience

The person behind the wheel matters the most, which is why insurers look at:

- Experience level: A seasoned driver with 10+ years of accident-free trucking will get lower insurance rates than an amateur driver.

- Driving record: Any violations such as Hours of Service (HOS) breach, accidents or speeding tickets, etc., are likely to increase the insurance cost.

- Safety training: Drivers given the proper training on driving courses or using telematics for real-time tracking often qualify for the discounts.

Coverage limits and deductibles

It’s simple math: the more coverage you have, the higher your premium.

- Higher coverage limits=higher premiums: if you opt for a $1 million liability policy instead of a minimum $750,000, you will need to pay more. Some brokers and shippers require higher limits.

- Higher deductibles=lower premiums: it means a lower upfront insurance cost that you pay out of your pocket to file a claim.

Cargo type and hauling distance

The load driver is carrying and the distance covered also play a crucial role in insurance rate.

- Cargo type: Some loads are riskier than others, like dry goods or retail items. This means lower risk. Refrigerated goods have the risk of spoilage, so it is covered as a medium risk. Hazardous materials such as fuel or chemicals are high risk and require special coverage.

- Hauling distance: The longer the distance, the chances of accidents increase with it:

- Local routes (within 100 miles)=lower premiums

- Regional hauls (100-500 miles)=moderate risk

- Long-haul trucking (cross-country)=higher premiums

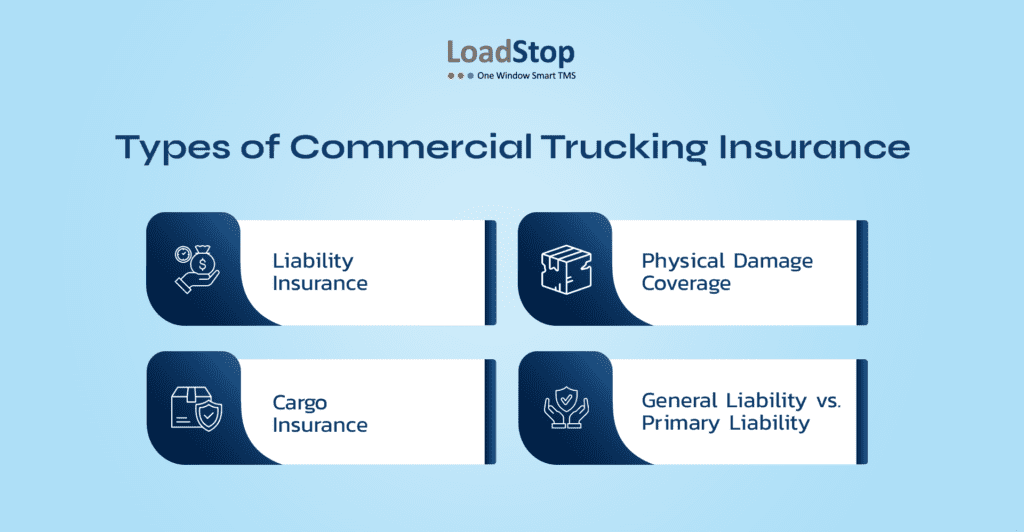

Types of commercial trucking insurance

Different risks are covered by different policies, and being aware of your alternatives can help you avoid unforeseen financial losses. Selecting the appropriate combination of coverage guarantees that you remain safe, compliant, and worry-free while driving, regardless of whether you are an owner-operator or fleet manager.

Liability insurance

The cornerstone of any commercial trucking policy is liability insurance. It covers harm or damage you cause to other people in an accident and is mandated by law.

- Primary liability insurance: Provides coverage for property damage and personal injury in the event that you cause an accident. Mandated by the FMCSA, depending on the type of cargo, the minimum coverage ranges from $750,000 to $5 million.

- General liability insurance: This covers events that don’t involve driving, like collisions at loading docks, damage to customers’ property, or lawsuit costs. Although it’s not always necessary, it’s strongly advised for complete protection.

Physical damage coverage

Your truck is your most valuable possession, thus, you need a quick fix if it is damaged. If your truck is damaged in a collision, theft, or natural disaster, physical damage insurance will pay for repairs or replacement.

- Collision coverage: Regardless of who is at blame, collision coverage covers damage to your truck during an accident.

- Comprehensive coverage: Provides coverage for non-collision damages, including as vandalism, theft, fire, and severe weather (such as floods and tornadoes).

Cargo insurance

Cargo insurance is essential if you’re transporting precious items. It protects against theft, damage, and freight loss during transportation.

- What’s included: The majority of general cargo, such as machinery, food items, and retail goods.

- What is not included: Certain policies require specific approvals and exclude high-value gadgets, drugs, and dangerous products.

Many shippers and brokers won’t work with you unless you carry at least $100,000 in cargo insurance, though high-value freight may require higher limits.

General liability vs. primary liability

- Primary liability: Insurance is legally required and covers damages/injuries if you cause an accident while driving.

- General liability: Insurance is optional but recommended and covers legal claims and accidents that happen off the road.

Strategies to reduce the average cost of trucking insurance

Trucking insurance is a major expense for owner-operators and fleet managers, but the good news is that there are smart strategies to lower your premiums. From leveraging technology to improving driver safety, implementing these cost-cutting measures can make a significant difference.

Use the right technology

Collision avoidance, lane departure warnings, and telematics are common examples of advanced safety systems that can help owner-operators reduce trucking insurance costs. Such precautions are usually taken into account, and insurance providers often lead to premium discounts and rewards.

Improve driver training

It is important to provide training to the drivers to minimize any errors or accidents on their part while grooming their driving behavior. Having a trained workforce at your end is a prime example of keeping the drivers, trucks, and goods safe, which can lead to reasonable insurance rates.

Use data analytics

Another strategy to implement is using fleet management software. Such technology helps to analyze driver’s behavior, their driving pattern and on its basis identify risks and implement the right measures to minimize accidents in future. So, if you have real-time data backed with live tracking, fleet managers can enhance the safety improvements to help you negotiate with the insurers.

Join industry associations

If you are not part of national associations, you might want to reconsider. Trucking companies can benefit from insurance rates and resource safety when they participate in state and national associations. As a customer, you will receive detailed and accurate information on how to improve the safety of the fleets and drivers.

Advocate Tort Reform

There’s legislation that limits the nuclear verdicts and excessive damages, making a stable ground environment for the business. As the insurance premium rates are usually high, this bill acts as a safeguard for trucking companies from being sued for crashes or other accidents unless it’s an employee’s fault.

Get competitive rates

It’s in your best interest to review insurance policies regularly and solicit quotes from various providers with the right pricing. This will help ensure you get the most competitive rates, and also, a broker who specializes in trucking insurance is the smartest way for compare and to get better deals.

How to find affordable trucking insurance without sacrificing coverage

You do not need to overpay for insurance. The key is to find affordable trucking insurance that offers comprehensive protection for the business, drivers, and cargo. Here’s what you can do:

Comparing multiple quotes

Because insurance rates highly vary from one provider to another. What you need to do is:

- Get at least 3-5 quotes from different insurance providers.

- Work with the trucking insurance broker who specialized in commercial policies.

- Compare the coverage limits, deductibles, and policy benefits along with pricing.

- If you bundle liability, some insurers offer multi-policy discounts for physical damage and cargo insurance together.

Choosing the right deductible

The money that you pay out of your pocket before the insurance is due sets a certain bar for you. Higher deductibles lower your premium, but it also means higher expenses. What you need to do is:

- Have a strong cash flow, with a higher deductible, that will lower the premium.

- To have a lower pocket cost after an accident, opt for a lower deductible.

Safety programs to lower premiums

Trucking companies prioritizing safety are in luck with the insurance companies as they reward this factor a lot. Enrolling safety programs and implementing risk-reduction strategies can help lower your rates. The safety program helps to

- Improve driver behavior and reduce accidents.

- Use tracking data with the help of telematics to prove safe driving habits to insurers.

- Keep trucks in the best condition to minimize breakdowns.

Discounts and cost-saving strategies

It easy to overlook discounts by trucking business that could have saved them thousands on insurance. Here’s how you can avail the cost reduction:

- Get a safe driving discount when you get rewarded for an accident-free driving history.

- Some insurers offer special pricing for new ventures.

- You can save money by combining policies such as liability, cargo, and physical damage.

- Truckers can pay the entire premium upfront instead of monthly installments.

How LoadStops help reduce trucking insurance rates

Risk factors like accident history, vehicle condition, and regulatory compliance have a significant impact on trucking insurance prices. Trucking companies can drastically minimize hazards by implementing cutting-edge fleet management technology, such as LoadStop, which lowers insurance prices. Modern features from LoadStop, such as driver teaching, compliance tools, predictive maintenance, and real-time tracking, make fleets safer and more effective, which appeals to insurers.

Real-time tracking and telematics

Trucking companies that take proactive steps to lower theft and accidents are eligible for discounted insurance rates from insurance carriers. Fleet managers may gain comprehensive insights into driver behavior, vehicle location, and operational efficiency with LoadStop’s real-time tracking and telematics system.

LoadStop assists in identifying dangerous driving behaviors before they result in accidents by keeping an eye on crucial driving behaviors like speeding, hard braking, fast bends, and abrupt lane changes. By lowering the possibility of cargo theft and unlawful vehicle use, the live GPS tracking capability improves security. Lower insurance premiums result from insurers classifying a fleet as lesser risk when they observe that the fleet actively monitors and corrects risky driving practices.

Predictive maintenance alerts

Unexpected malfunctions and technical problems may lead to insurance claims, which raise rates. By evaluating real-time truck diagnostics and sending out automated alerts for necessary repairs, LoadStop’s predictive maintenance system assists trucking companies in staying ahead of possible vehicle problems.

This preventative strategy lowers the chance of roadside failures, keeps cars in peak condition, and helps avoid expensive emergency repairs. Because well-maintained fleets are less likely to experience accidents as a result of mechanical issues, insurance firms prefer them.

Compliance and safety management

Infractions of regulations may result in severe fines, legal problems, and increased insurance costs. Trucking companies may ensure that their operations satisfy all safety and paperwork standards by using LoadStop’s compliance and safety management solutions, which help them stay in compliance with FMCSA regulations.

By automatically monitoring Hours of Service (HOS) logs, the technology lowers the chance of accidents caused by exhaustion and makes sure that drivers don’t go over the legal driving limit. Additionally, LoadStop helps fleets pass audits and stay out of trouble by maintaining an accurate record of inspections, maintenance plans, and compliance reports.

Driver scorecards and coaching

The accident history of a fleet is one of the main variables influencing trucking insurance prices. Businesses with high-risk behavior, bad driving histories, and a history of claims are subject to higher premiums from insurers. By monitoring safety measures and giving immediate feedback, LoadStop’s driver scorecard and coaching system enhances driver performance.

Drivers are given safety scores by the platform according to their actions, such as speeding, harsh braking, and careless driving. These data can be used by fleet management to identify drivers that pose a high risk.

It’s time to save on trucking insurance

One of the largest costs in the business is truck insurance, but you may drastically reduce your rates without compromising coverage if you use the correct tactics. You may lower risks, increase productivity, and bargain for lower insurance rates by making investments in safety technologies, educating drivers, upholding compliance, and utilizing fleet management systems like LoadStop.

Low-risk, well-managed fleets are rewarded by insurers, and LoadStop offers the real-time tracking, predictive maintenance, compliance tools, and driver coaching required to increase the safety and economy of your trucking company. By being proactive now, you may save expenses, boost profitability.

Ready to lower your insurance rates?

Book a DemoFAQs

The average cost of trucking insurance varies based on several factors, including the truck type, driving history, and coverage options. On average, owner-operators with authority can expect to pay between $8,000 and $15,000 annually, while leased operators typically pay $3,000 to $5,000 annually.

When giving a quote, insurance providers ask for driver details, truck information, type of cargo hauled, operating radius, and coverage limits desired.

LoadStop improves fleet safety, efficiency, and compliance, which lowers trucking insurance rates. LoadStop monitors driver behavior using real-time telematics, lowering the risk of accidents through proactive coaching and observation. By preventing expensive malfunctions, its predictive maintenance technology reduces claims that can raise insurance premiums.